Crypto trading relies heavily on bots, but they also manipulate markets, disrupt airdrops, and extract billions in MEV.

Crypto trading today cannot function without bots, but their influence often comes at the expense of honest traders and blockchain users. Whether executing algorithmic trades on memecoins or manipulating the timing of airdrops, bots are pervasive in the crypto space.

These automated programs operate with speed and precision far beyond human capabilities, working tirelessly 24/7 to perform their functions. However, the benefits they provide to their operators often result in significant negative consequences for the broader market. Their ability to act at inhuman speed and accuracy creates imbalances, distorting market dynamics and creating an uneven playing field.

Crypto bots have even been observed creating and launching new memecoins on Solana, while simultaneously pulling liquidity from older coins in what can only be described as rug pulls.

How Crypto Bots Manipulate Memecoin Markets and Airdrops

Rampant bot activity also causes severe congestion on blockchain networks, driving up transaction fees and slowing processing times. Solana, which overtook Ethereum in fee revenue this week, has directly experienced the negative impact of bot-driven behavior, particularly during the 2024 memecoin craze.

The network faced severe congestion issues, with as many as 75% of transactions failing. “These thousands of meme tokens launched on Solana — it’s all automated, and it’s 100% impacting people,” says Ganesh Swami, CEO of data infrastructure firm Covalent.

“Forget the economic value — the network just becomes unusable.”

The situation worsened to the point where Solana developers were forced to release an update in April to address the congestion. Though Solana has been in the spotlight recently, these issues are not confined to one network. Bots target any profitable crypto trend, creating widespread problems.

The Rise of MEV: Crypto Bots Extracting Billions from Ethereum Transactions

One of the most common uses of crypto bots is for Maximal Extractable Value (MEV) — also known as the “invisible tax.” On blockchains like Ethereum, transactions are not processed chronologically. Instead, validators prioritize transactions based on the transaction fees attached to them. This allows bots to insert their own transactions into the queue, capitalizing on profitable opportunities.

MEV bots can extract additional profits by “front-running” large trades, or by sandwiching transactions — inserting their own trades before and after large transactions to take advantage of expected price changes. This hidden profit is an example of MEV.

Bots scan through the mempool (the transaction queue before data hits the blockchain) for opportunities to extract MEV. While bots are not inherently malicious and serve important roles, such as market-making and liquidity provision, they often take advantage of vulnerabilities in the system.

Mathias Beke, co-founder of market-making firm Kairon Labs, explains: “We’re talking about microsecond optimizations, which obviously is not possible for humans. Without automation, our business would not be scalable.”

Beke estimates that without bots, his firm would need to hire about 200 additional people to manage market-making tasks. “In high-frequency trading, the bot becomes such a core component that it needs a dedicated team of 20 to 30 people to maintain it,” he says.

Solana’s Memecoin Craze: Crypto Bot-Driven Launches and Rug Pulls

Solana’s memecoin craze continues to fuel the bot-driven launch of new tokens, though the market has cooled somewhat since its peak earlier in 2024. In the week leading up to July 19, approximately 2,600 new Solana-based memecoins with liquidity were launched. This is a drop from the 19,000 new tokens launched in a single week earlier in the year.

Bots are driving much of this activity, automating the creation of new tokens on platforms like Pump.fun, and artificially inflating trading volumes by creating multiple wallets to simulate trading activity. One sample wallet on Solana holds over 3,500 different tokens, most of which are memecoins.

While some bots automate the launch of memecoins by scanning market trends, they often skip critical steps like deploying smart contracts properly or conducting audits. According to Big_Cat, product lead for Solana-based memecoin project Laika, “When bots are used to launch memecoins without proper checks, it can lead to unethical practices and risks that tarnish the industry’s reputation.”

A sample wallet on Solana displayed troubling activity, rapidly minting new tokens while simultaneously removing liquidity from others — a red flag often associated with rug pulls.

Despite the prevalence of malicious bots, there are bots that play a positive role. Laika, for example, successfully used a Telegram bot integrated with BNB Chain to launch an initial presale, making it easier for users unfamiliar with Web3 wallets to participate early on.

MEV and Its Impact on Ethereum

Between 2020 and 2022, Ethereum saw $675.6 million in MEV extraction, according to data from Flashbots. Post-Merge, this number has ballooned, with $1.78 billion in MEV being extracted from Ethereum transactions.

Some argue that MEV is now a natural and even necessary part of blockchain operations, capitalizing on the transparency of mempool data. Others, however, view MEV as an illegitimate form of profit extraction by network operators.

One particularly harmful form of MEV is the sandwich attack, where an MEV bot spots a large transaction in the mempool (such as a large buy order) and profits by front-running and back-running the trade. The attacker buys the asset before the large order and then sells it at a higher price after the order is processed. The victim, in turn, suffers from higher fees and slippage.

Some networks, including Solana and MultiversX, have taken steps to mitigate sandwich attacks. For example, Solana removed a group of validators from its delegation program after they were found to be involved in sandwich attacks. Similarly, MultiversX introduced random transaction sorting to reduce bot activity, with promising results.

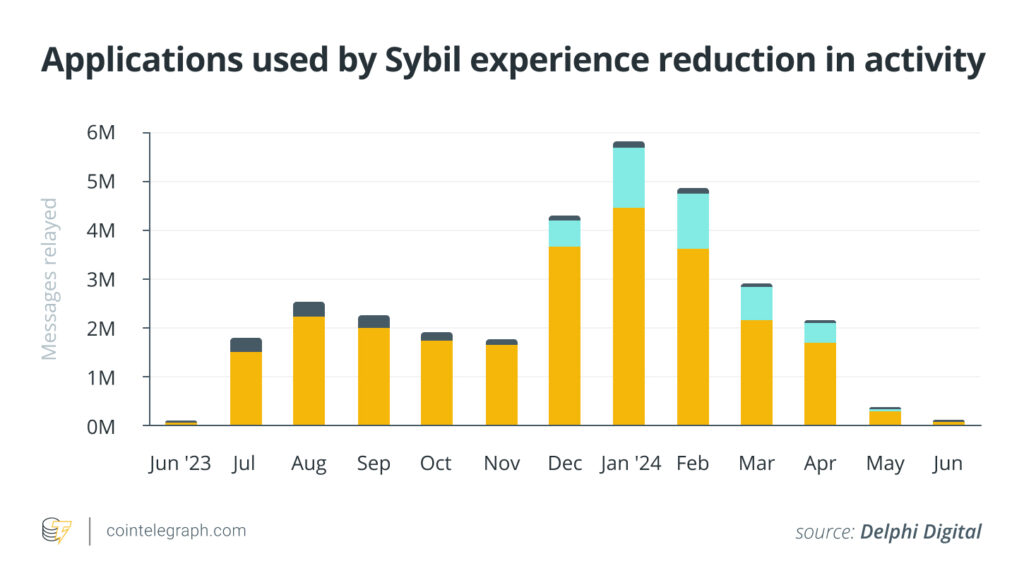

Crypto Bots and Sybil Farming: The Impact on Airdrops

In recent years, airdrops have become a popular method for projects to distribute tokens without falling afoul of regulatory agencies like the SEC. However, the rise of bot-driven airdrop farming has undermined the integrity of these distribution methods.

Bots are now used to perform the required tasks for airdrops across multiple addresses, leading to a disproportionate number of rewards going to bot operators rather than genuine users. Some of the largest airdrops this year have faced significant backlash due to this bot-driven activity.

“Industrial airdrop farming has only ramped up in the last 12 months, driven by the economic value of these activities,” says Swami. “It’s created a distorted market where bots and Sybil farmers dominate opportunities for genuine users.”

Despite efforts to curb this, airdrop farming remains a widespread problem. LayerZero, for example, faced challenges during its airdrop distribution, with many Sybil wallets bypassing filtering mechanisms and receiving their share of rewards.

ZKsync, which launched recently, was criticized for lacking proper anti-Sybil measures, resulting in unfair distributions.

The Future of Crypto: Balancing Bots with Fair Market Practices

Despite the challenges posed by bots, experts agree that their role in the crypto ecosystem will only grow. MEV is expected to remain a dominant force, though it risks eroding trust in the market as more and more value is extracted from legitimate users.

Meanwhile, projects are working hard to mitigate bot activity, especially in areas like airdrops and token launches. “Bots may be inevitable, but we need to find ways to keep the ecosystem fair and sustainable,” says Swami.

The future of crypto will likely involve finding a balance between the efficiencies that bots provide and the need for fairness and transparency in market operations.